owners draw report in quickbooks online

I have Quickbooks Simple Start online for my business and I want to file my taxes using TurboTax online self-employed. How do I import my info from quickbooks into turbotax.

If you are a small business owner or running a proprietorship firm then it is essential for you to know how to record S-Corp distribution in QuickBooks easily.

. Select Chart of Account under. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. The information contained in this article is not tax or legal.

When you have an LLC all income flows through to the owners of the LLC on the K-1. As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the Estimated Quarterly Self-Employment Taxes you will owe to the IRS. Help with Owner Salary or Draw Posting in QuickBooks Online.

An owners draw also called a draw is when a business owner takes funds out of their business for personal use. This means whether or not you take a draw you will be taxed on your share of the income the LLC receives. A members draw also known as an owners draw or a partners draw is a quickbooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the.

For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership. The 1065 is simply an informational return. The owner draws will simply decrease each individual capital account.

In QuickBooks Desktop software. 2 Create an equity account and categorize as Owners Draw. The memo field is.

I have read that the online versions of Quickbooks and TurboTax do not speak to each other unless you specifically have Quickbooks self-employed which I do not. Make sure you use owners contributionsdraws equity vs. Business owners might use a draw for compensation versus paying themselves a salary.

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. In fact the best recommended practice is to create an owners draw. Owners equity is made up of different funds including money youve.

Fill in the check fields. Choose the bank account where your money will be withdrawn. Then choose the option Write Checks.

Corporations should be using a liability account and not equity. To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks. How do i run that report.

An owners draw account is an equity account used by quickbooks online to track withdrawals of the companys assets to pay an owner. Due tofrom owner long term liability correctly. 1 Create each owner or partner as a VendorSupplier.

An owner of a C corporation may not. To write a check from an owners equity account. To do so you are required to select the option of Chart of account at the QuickBooks online homepage and click on the feature option and now open the new tab and move to the drop-down bar of Account Type and choose the Equity option and.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. An owner-draw is not reported on the K-1. Expenses VendorsSuppliers Choose New.

You will setup an EFTPS Electronic Federal Tax Payment. To Write A Check From An Owners Draw Account the steps are as follows. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

Before we discuss those steps we hereby guide you about escort in detail. Enter and save the information. An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw.

Youre allowed to withdraw from your share of the businesss value. A draw lowers the owners equity in the business. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name.

In this article you will get to know all the easy steps for the recording of S-Corp distribution in QuickBooks. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to.

Click on the Banking menu option. If youre the business owner and want to record an owners draw youll basically want to write the check out to yourself like you are paying yourself with a check. Select Print later if you want to print the check.

As a business owner at least a part of your business bank account belongs to you. Procedure to Set up Owners Draw in QuickBooks Online The Owners draw can be setup via charts of account option. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business.

I just want a report on owners draw. In the Account field be sure to select Owners equity you created. Write Checks from the Owners Draw Account.

Enter the account name and description Owners Draw is recommended When you are done hit on Save Close button. Owners draws are usually taken from your owners equity account.

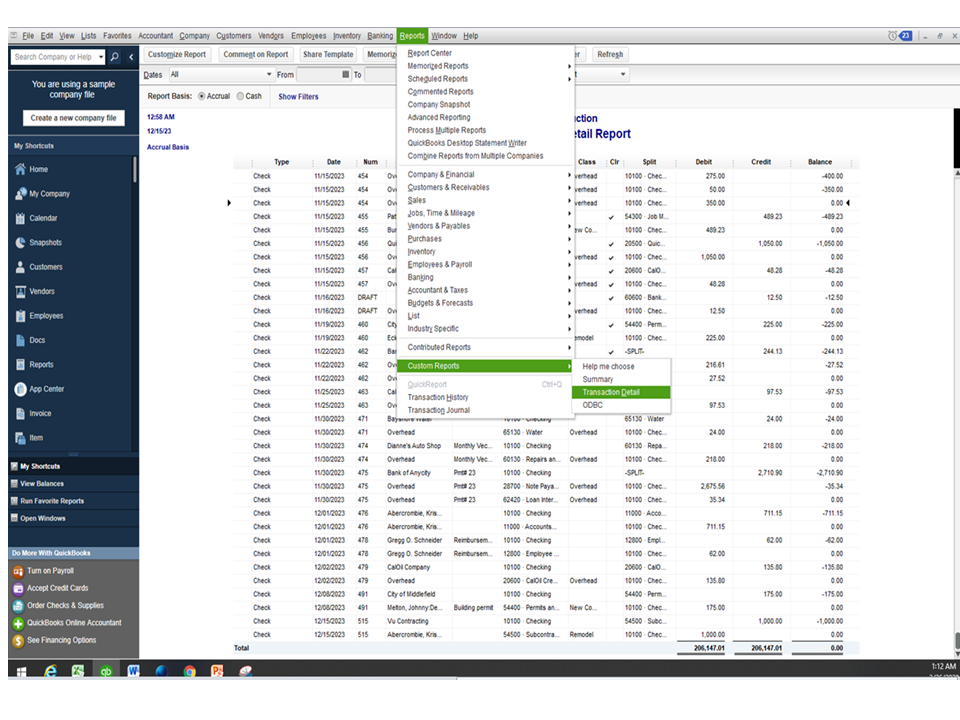

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Solved How Do I Create A Custom Report For A Specific Account

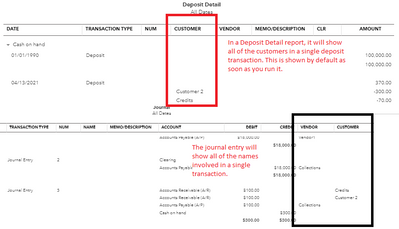

Think Of The Undeposited Funds Account As An Envelope Where You Keep Checks The First Time You Receive Payments Use A Payment Quickbooks Fund Accounting Fund

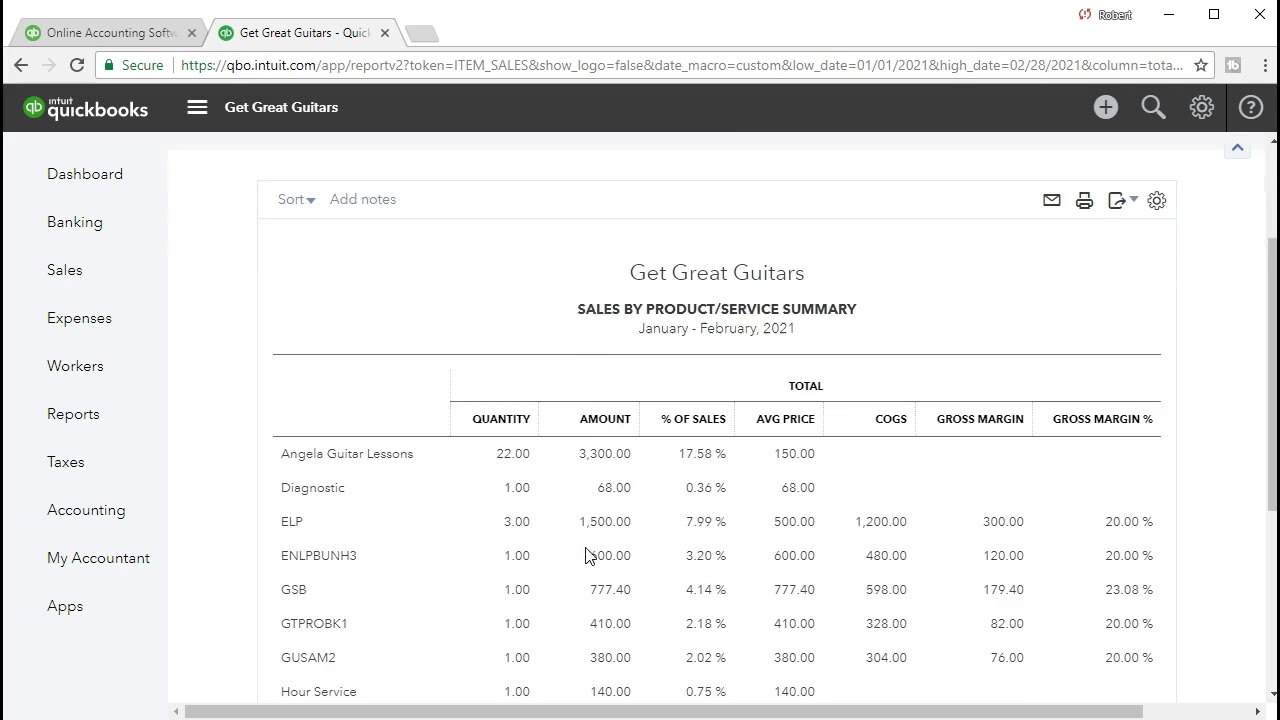

Quickbooks Online 4 25 Sales By Item Summary Report U Youtube

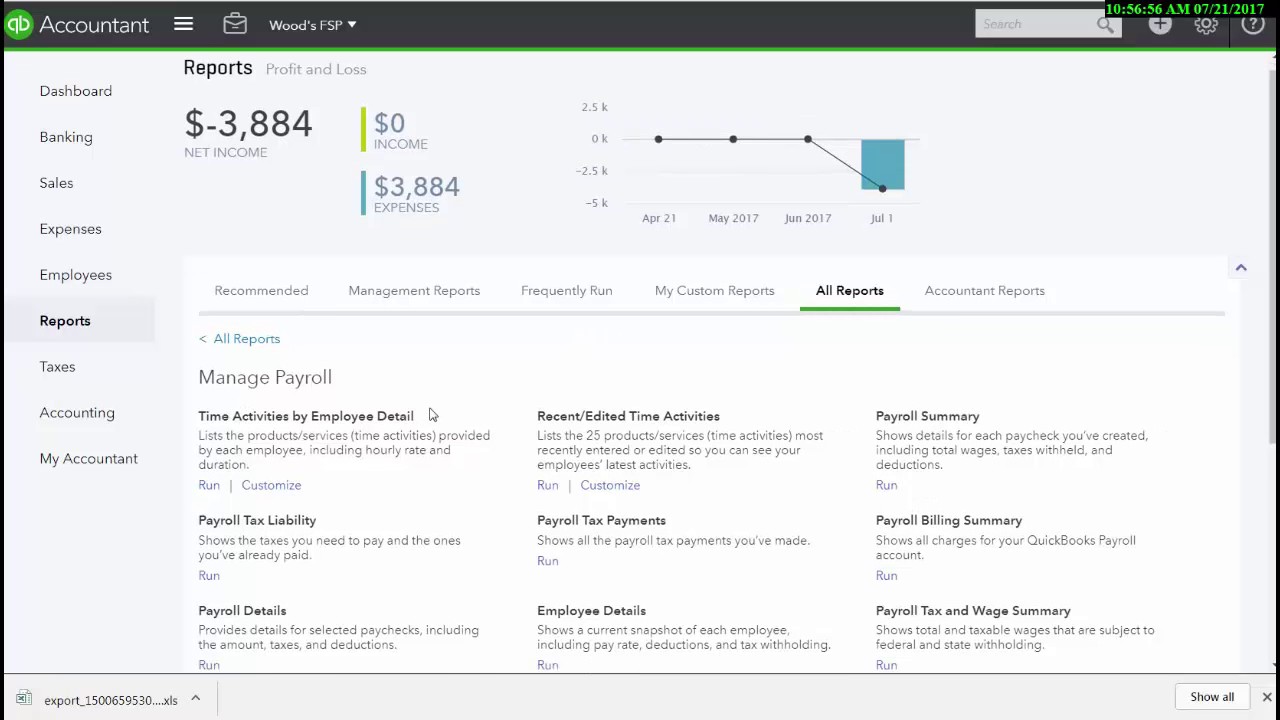

Quickbooks Online Full Service Payroll Report Navigation Youtube

Solved How Do I Create A Custom Report For A Specific Account

Report Only Users In Quickbooks Online Youtube

Save Custom Reports In Quickbooks Online Instructions Quickbooks Online Quickbooks Best Templates

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

How To Save Customized Reports In Quickbooks Online Tutorial Youtube

Solved How Do I Create A Custom Report For A Specific Account

Quickbooks Help How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates Great Cre Quickbooks Help Quickbooks Check Register

Best 4 Quickbooks Chart Of Accounts Template You Calendars Https Www Youcalendars Com Quickbooks Cha Quickbooks Chart Of Accounts How To Use Quickbooks

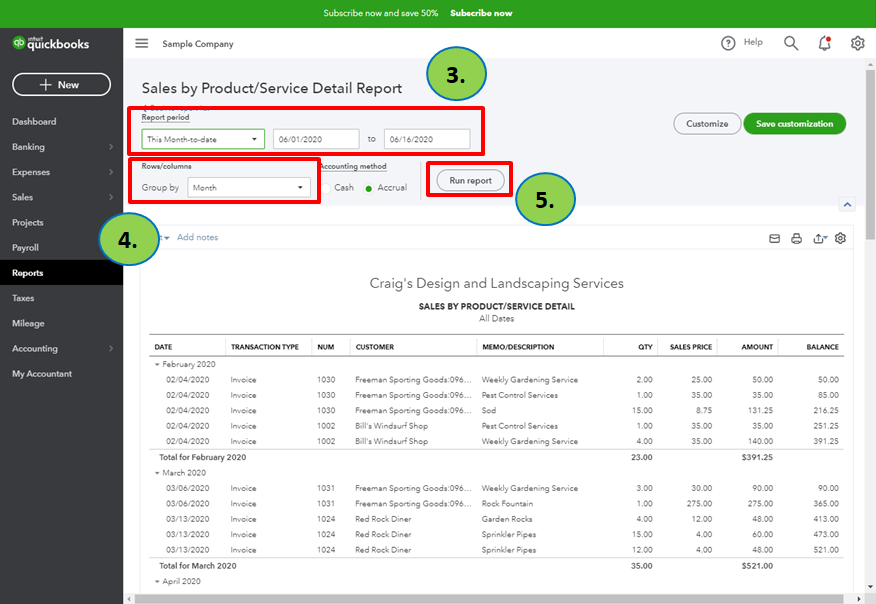

How Do I Run A Month To Month Sales Revenues Comparison For 2018

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Solved How Do I Get Totals To Show Up On A Check Detail R

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting